US Pharm. 2007;32(7)(OTC suppl):4-6.

Community pharmacists can influence how OTC

medications should be used and, in many instances, which products are

actually purchased by patients. According to the U.S. Pharmacist 2007

OTC Survey, more than half (58.1%) of the pharmacists polled reported that

they "very often" field questions from patients that are specifically related

to OTC products, and an overwhelming majority (94.7%) said they have an active

role in counseling patients about OTC medications. What does this mean for

patients and the companies that manufacture OTC products? For patients, it

means better control over their ability to self-medicate; for manufacturers,

pharmacists' consultations usually translate into a sale of their product.

Since pharmacists are

consistently ranked as one of the most trusted health care professionals, it

should come as no surprise that consumers often turn to them for information

about OTC products.

The Self-Medication Trend

Because

self-medication is a growing trend, pharmacist consultations and

recommendations of OTC products have an important role in health care.

According to a 2006 survey by Roper Starch Worldwide, almost 60% of Americans

are more likely to treat themselves than they were the year before. In fact,

73% said they would rather treat themselves than see a physician. In addition,

62% of respondents said they would self-medicate in the future, and 96% said

they were generally confident about the health care decisions they make.

Manufacturers of OTC products

have accommodated this growing trend by launching new and innovative OTC

products and by adding to product lines of proven favorites. According to

Nielsen data, this has propelled OTC sales to a more than $15.4 billion

business. Increased OTC sales and the desire to self-medicate have been fueled

by many factors, including rising medical costs, limited physician office

hours, convenient pharmacy locations, availability of pharmacists to answer

consumers' questions, and the plethora of products that have switched from

prescription to OTC status over the years.

The Consumer Healthcare

Products Association reported that since 1975, there have been nearly 100

products switched from prescription to OTC status. Generally, prescription

medications are switched to OTC status once they have been on the market for

some time and have proven to have a wide margin of safety and efficacy.

However, products that were once prescription tend to be more potent than

their nonprescription predecessors in their respective therapeutic categories

and might potentially produce more serious side effects that require

pharmacist intervention.

Survey Demographics

The majority of

pharmacists who responded to the U.S. Pharmacistsurvey were from chain

pharmacies (41.4%) and independent retail pharmacies (34.4%). Other

respondents included pharmacists working at supermarket pharmacies, discount

store pharmacies, and health systems and managed care facilities.

More than three-quarters

(80.6%) of the respondents classified themselves as a staff pharmacist; 9.7%

said they were a chief pharmacist, a director of pharmacy, or a supervisor.

The remaining categories consisted of a combination of consultant pharmacists

and those working in academia.

When asked what approximate

percentage of their pharmacy business comprised OTC product sales, 43.7%

responded between 11% and 25%, and 37.6% said between 1% and 10%; the

remaining 18.8% said that 26% or more of their business was related to OTC

sales.

Pharmacist Consultation

Because of their

availability and close proximity to patients who purchase OTC medications,

retail community pharmacists are in the best position to counsel patients on

the choice and use of OTC medications and related health care products. The

U.S. Pharmacist survey confirmed that many pharmacists are already

providing this valuable professional service. More than 90% said they take an

active role in counseling patients on OTC-related products. According to

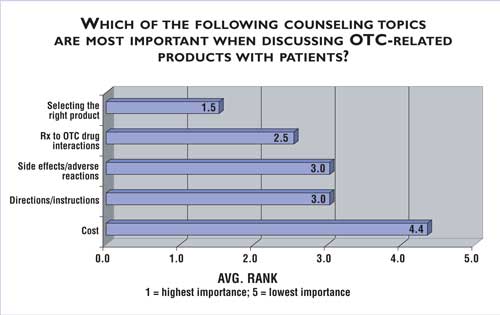

respondents,

selecting the appropriate product is the biggest concern for most patients. Other important

counseling topics included

prescription-to-OTC drug interactions, side effects, adverse reactions, and instructions

on how to take the medication. Cost was lower on the list of important issues.

When discussing drug

interactions, patients primarily asked whether or not the product could be

taken with other drugs. Other questions concerning drug interactions included:

• What are the signs of

a drug interaction?

• What foods/beverages

should be avoided?

• How does the product

work?

• Is there additional

information available about the product or medical condition?

The survey revealed that 41.6%

of the pharmacists make recommendations for six to 10 OTC products per day.

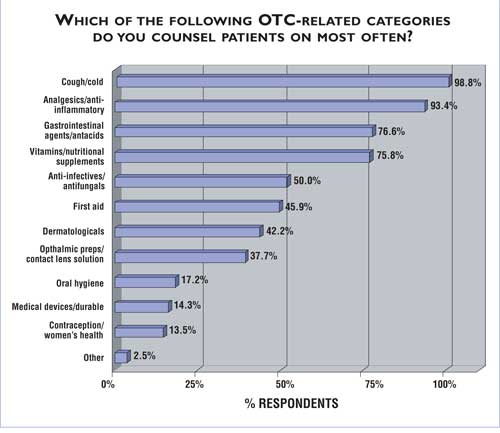

When asked which products pharmacists counseled patients on most frequently,

98.8% answered cough and cold products, followed closely by

analgesics/anti-inflammatory drugs (93.4%) and gastrointestinal

agents/antacids (76.6%), and vitamins/nutritional supplements (75.8%). Other

products that pharmacists commonly counseled patients on included anti-infec

tives/antifungal agents (50.0%), dermatologic medications (42.2%), first aid

(45.9%), ophthalmic products including con tact lens solutions (37.7%), oral

hygiene (17.2%), medical devices and durable medical equipment (14.3%),

contraception and other women's health products (13.5%), and other product

categories (2.5%), including laxatives and anti-smoking products.

Where Pharmacists Get Their Information

When pharmacists

were asked about which educational tools they need to initiate consultative

services with patients who are thinking of purchasing an OTC product, their

response was split between patient education materials and product information

guides. More pharmacists believed that pharmaceutical companies are not

providing them with enough information to carry out their consultative

services--45.2% answered "yes," while 54.8% answered "no."

More than three-quarters

(86.9%) of all the pharmacists said they garner OTC-specific product

information from articles written in professional journals and supplements.

Other useful resources they cited were the Internet (29.9%), product-specific

mail from pharmaceutical companies (35.7%), pharmacy association conferences

(16.4%), multiple product information from independent direct mail companies

(20.5%), and "other sources," including continuing education courses, product

labels, information learned in pharmacy school, personal experience, and

pharmacy review books.

The survey also explored what

types of information pharmacists would like to receive. The five most

important pieces of information were, in descending order, potential

interactions of OTC products with prescribed therapy, treatment of diseases or

conditions with OTC therapy, concurrent use of OTC products with prescribed

therapy, prevention of diseases or conditions with OTC therapy, and a focus on

specific OTC products and/or categories.

Conclusion

The results of the

U.S. Pharmacist 2007 OTC Survey uncovers the key role that pharmacist

counseling has in ensuring that patients are adequately educated about the OTC

products they purchase. Because of the pharmacist's availability to patients,

they are often asked questions concerning OTC products, their side effects,

and the differences between one OTC product and another. Pharmacists also have

an important role is consulting with patients about possible drug–drug

intereactions with the presciption drugs they are taking. In some instances a

patient may be taking the same ingredient they have already been prescribed,

and in other cases, the OTCmay interact with their prescription medication.

The pharmacist is in the best position to recommend one product over another

based on their discussions with the patient.

With more potent

prescription-to-OTC medications making their way to pharmacy shelves, it is

important that pharmacists receive up-to-date information about these products

in order to help patients make informative decisions about their OTC purchases.

To comment on this

article, contact editor@uspharmacist.com.